Worried about SA's economy? Here's how to sleep a little better at night.

Howzit tjommas!

Recently, I've been getting a lot of questions from readers in South Africa who are stressed about our economy. People who don't want to leave the country, but are worried about what will happen to their finances if there continues to be political and economic instability.

Although let's be real, it's 2022, where isn't there political and economic instability? (Shut up, New Zealand, Uruguay and Singapore)

There are two quite different levels of worry here:

- Worrying that South Africa's economy will continue to underperform, meaning that things will slowly continue to get more difficult, the value of your savings and investments will decrease, the prices of everything will rise, the real value of wages will stagnate, and you'll be able to buy less and less with your money.

- Worrying that shit will truly hit the fan and South Africa will face a national banking crisis or hyperinflation. I'll be referring to this as a SHTF scenario.

Economists call this country risk: the risk of your own country's economy doing badly. And here's the good news: there are concrete things you can do to reduce its impact on your own finances.

There are concrete things you can do to help improve the overall situation, too, but I'm less confident I know what they are :)

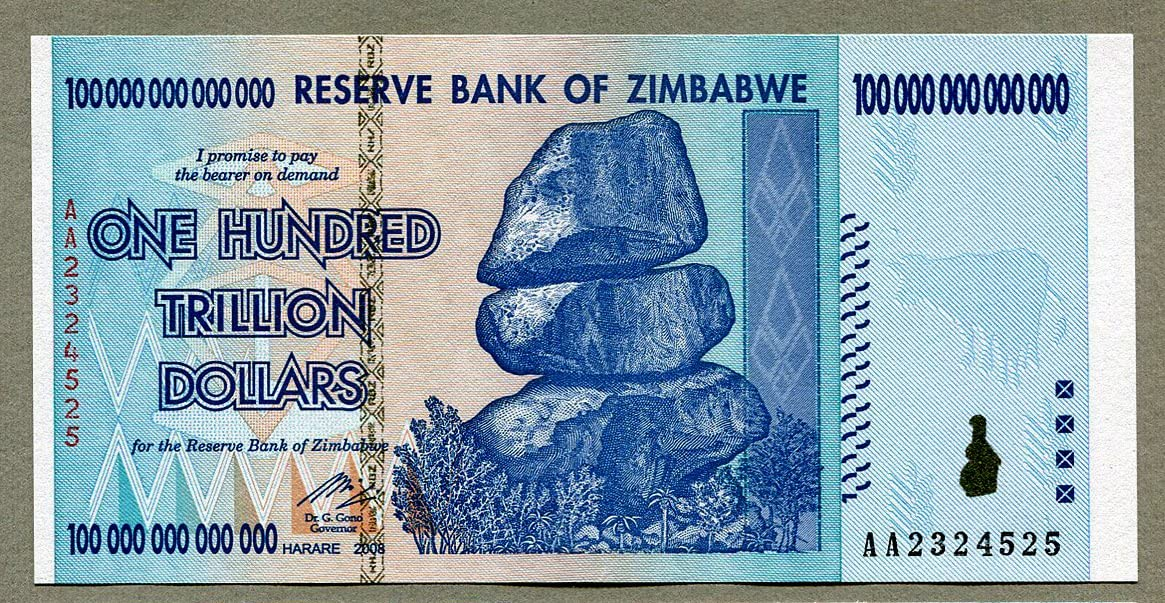

What does a SHTF situation look like?

While I don't think it's likely to happen in South Africa, let's talk about the worst case scenario for country risk: a national banking crisis accompanied by hyperinflation. I was briefly in Zimbabwe in 2009, and inflation was so bad that salaries were being re-set once a week, and people were being paid in petrol vouchers because they held their value longer than the Zim Dollar. You could also look at what happened in Cyprus in 2013, where the government effectively "confiscated" money directly out of consumer savings accounts to pay a once-off state levy. Or consider the 2002 Uruguay Banking Crisis where all banks in the country were frozen and people could not access their own money. Financial crises are rare, but they do happen.

In the case of a financial crisis, some relevant questions are:

- Is the real value of your money protected? (are you protected against hyperinflation of your own currency?)

- Where is the legal entity registered that controls your money? (are you protected against your government claiming your money?)

- Can you practically access your money, and practically spend it? (are you protected against a bank freeze?)

There are things you can do to protect against all of these situations, but they all cost you. The safest thing to have in a SHTF situation is probably wads of US Dollars in a suitcase, or gold bars, or canned food you can trade with your neighbours. But, obviously, those are all pretty useless investments in normal times, and they expose you to other risks (theft, fluctuating gold prices, being a bit peckish). You've got to balance your desire to ease your fears about economic collapse, with all your other financial goals.

Overall, I believe it's more useful to focus on managing the risks of South Africa's economy underperforming, and not over-invest in preparing for an unlikely SHTF situation. But I will mention options that support both goals.

Just to say - friends, I know things are blimmen hard out there right now, and a lot of my own loved ones have been out of work for such a long time that they've already depleted their savings. If you're already in financial crisis, this might be of more help right now, and please know that I'm beaming you so much love.

Tactic 1: Invest in global funds

Your country's economy is just a small part of the world's economy. Unless you've got a good reason not to, it makes sense for most people to try to invest in funds that diversify your money all around the world. It's one of the simplest, most impactful ways to reduce your country risk.

Luckily, there's a very easy way to do this: invest in global funds. Specifically, invest in low-fee global ETFs.

You can imagine a global ETF as a basket made up of tiny tiny bits of companies from all around the world. They're super simple products, and they keep your money safe through diversification (spreading your eggs across many many baskets). You can start investing in global ETFs even if you only have ten bucks. If South Africa's economy underperforms, the value of your investments will be protected.

There are two ways to buy global ETFs in South Africa:

- Locally-listed global ETFs. These are ETFs that are listed on South African stock exchanges, but they're made up of international shares. An example is the Satrix MSCI World ETF. You can buy these easily using South African Rands, on a platform like EasyEquities.

- Offshore global ETFs. This is where you open up an actual offshore investment account and buy global ETFs listed on a foreign stock market. Sometimes, you first need to convert your money into US Dollars or Pounds to buy these ETFs, which means you do need to take currency conversion costs into account when comparing fees. EasyEquities offers USD investment accounts. Other international platforms available to South Africans include IG, Degiro, Interactive Brokers, and Trading 212.

There are pros and cons to both approaches. Locally-listed global ETFs are simpler to start off with, so usually a good jumping-off point for most people. You can use your annual tax free allowance for them. But they don't do much to help you in a SHTF situation: there's no use having money invested in an ETF if the country's banks are frozen and you have no way to actually withdraw any of it.

True offshore global ETFs might be more help in a SHTF situation, but you can't use your tax free allowance for them. They're more hassle to set up, and they're tricky when it comes to taxes, especially taxes after you die. If you've got a lot of money at stake, talk to a good fee-based financial planner or international tax expert to help you figure out what route's right for you. Or, read this.

South Africans, here's a list of good global ETFs to get you started (UK readers, here's one for you). And here's a short discussion about my all-time favourite global ETFs (the Satrix MSCI World ETF in South Africa and the FTSE Global All Cap Index Fund in the UK).

South Africans are allowed to take R1-million a year out of the country without any problems (this is called the single discretionary allowance). You can take up to R10-million a year if you complete some paperwork for the Reserve Bank, and more under special circumstances. But if you’re moving sums that big around, definitely talk to an expert.

A sidenote. Global diversification is smart no matter where you live. But if you live in the United States, remember that the US makes up over 50% of most global funds. So, if you're trying to reduce country risk, you might want to look for a global ETF that explicitly excludes US stocks - the Vanguard Total International Stock (VXUS) is a popular one.

Tactic 2: Buy foreign currencies

Investing is for money you don’t intend to spend for a while. But what about your savings - the cash you keep available for short-term big purchases and emergencies?

Generally, you likely want to keep your savings in a normal, easy-to-access savings account, in your own currency. But if your country is feeling especially volatile, you might consider shifting some of your cash into foreign currencies (forex).

Understand that buying foreign currencies reduces your country risk but it means you now face a new, potentially bigger risk: the risk of currency fluctuation. What if your own currency outperforms the other currency and you lose the value of your savings, that you most likely want to spend in your own currency?

In other words, be careful buying foreign currencies. It's a gamble in a way that buying global ETFs isn't (global ETFs are very diversified, hence inherently safer). I'd suggest limiting this to a portion of your savings.

There are many options for easily turning some of your rands into US Dollars, Pounds or other currencies, as a South African:

- An excellent app from Standard Bank called Shyft. This is a very easy-to-use, cost-effective way to buy foreign currencies if you're worried about the Rand devaluing. You can also order debit cards linked to the accounts, which makes this a great way to pay for things when you travel. It's a great solution if you want to buy forex.

- Actual physical paper currency that you buy from a forex counter and keep in a bug-out bag if you’re that kind of person. This is the most useful money to have in a true SHTF crisis, but you've got to worry about keeping it safe.

- By opening an offshore bank account through your existing South African bank. Most of the big South African banks offer offshore bank accounts. FNB and Standard Bank offer accounts in the Isle of Man, Investec offers accounts in the Channel Islands and Mauritius, Absa offers a Mauritius account (as far as I know, you’re out of luck at Capitec and Nedbank). You can use these bank accounts through the same apps/online banking profiles you already use, but the money you put into that account will be converted into a foreign currency (often Pounds). You get a full foreign bank account with its own card, and you can make international transactions out of this account just like a normal foreign bank account. These accounts are usually governed both by the banking regulations of the country they're based in, and by the South African banking regulators, which means that they're not entirely protected against the worst SHTF situations.

- By opening an offshore account with a completely foreign bank. There are banks in other countries (like the Channel Islands, Switzerland, Estonia) that allow foreign residents to open accounts with them. These are great if SHTF and you can leave the country. These accounts are usually expensive and require big deposits, and sometimes you actually have to travel to that country to meet with a relationship banker and prove you're a real person (or so I hear - I don't have one of these accounts, I just happen to know some kak rich people). This is an option if you've got a LOT of Randelas lying around and happy to pay a chunk of money to keep them safe. Some people use these types of accounts for tax evasion but there are also legitimate reasons to have them.

- By opening a bank account as a short-term resident of another country. If you ever find yourself spending a few weeks in another country, say for a work trip, here's a pro-tip for you: see if you can open a bank account while you're there. Like, if you ever come to the UK, all you need to do is change your location on the app store to the UK, download Revolut or Monzo, show an Airbnb booking as your proof-of-residence, and you can sign up for a free, fully-fledged UK bank account. Some other countries have similar options, just do your homework before you arrive. If you can find a bank that lets you sign up, this is the best way to get all the benefits of option 4 without the expense.

Tactic 3: Buy collectibles or crypto... maybe

In times of economic instability, a lot of people buy stuff that is pretty good at holding onto its value no matter what happens to the local currency. Classically, that's gold or silver, but other options include artworks, rare bottles of wine, Magic: the Gathering cards... whatever you could imagine transporting and reselling easily in a SHTF situation. Cryptocurrencies and NFTs can be considered more modern versions of these types of assets.

Of course the issue with these types of assets is that their value is often speculative, which means you have to do a lot of research to get a good deal, and they're pretty unreliable stores of value. They can also be a damn hassle to keep safe. Overall, I'd say that buying these classes of assets means you’re increasing your financial risks rather than decreasing them, but these could be a part of a very carefully-considered highly diversified portfolio for the wary. I would not suggest you put more into speculative assets than you could afford to lose.

Think holistically about your country risk

Life is short and all of these things you could do to reduce your country risk cost you something: your time, fees, or just the opportunity cost of all the other things you could have done with that money. Again, you have to balance reducing your country risk with your other financial goals.

One way to think about country risk is to ask how tightly connected your personal financial fortunes are to the financial fortunes of the country you live in. If the economy drives off a cliff, are you in the passenger seat of the car, or are you in a sidecar that can be detached if necessary?

A lot of this isn't about money at all. Some life decisions strengthen the connection between your personal finances, and the country's finances (i.e. they increase your country risk):

- Having only one passport, especially if that passport doesn’t allow you to live in many other countries.

- Investing your money in your own country.

- Keeping your savings in the country you live in.

- Owning a house.

- Being employed by a business that mostly operates in the country you live in.

- Owning a business that mostly operates in the country you live in.

- Having built up your “career capital” (your reputation and network) in just one country.

- Having people you love live in the same country as you (if things got tough, they’re likely to need your financial help at the same time as your own finances are struggling).

Overall, it’s much easier to move money than to move people (ask me and the 20 spreadsheets I made for our move to England). So you can definitely look into reducing your risk by making some big lifestyle changes like getting a job at a big multinational so it would be easier for you to relocate to another country if you needed to, but it’s much easier for most people to start off by asking how you can diversify your savings and investments outside of South Africa.

You can think about these factors as being weights on a scale that you can offset from each other. If you’ve got a lot of things that increase your country risk (like, you own a house and you’ve got a big family that you’d want to support if things got hard), then it’s extra important to decrease your country risk wherever you can (prioritise investing your money overseas). If you have fewer things tying you down, then this isn’t a risk you need to think about so much.

Here's a concrete example of where you might need to make trade-offs: saving for your retirement. You get sweet, sweet tax breaks by saving for retirement using a special retirement product called a retirement annuity (or a pension fund or provident fund). But there are limits about how much of your retirement money can be invested in global funds. So you have to decide whether to prioritise using your tax-free allowance to invest in global ETFs (reducing your country risk), or prioritising the tax breaks you get from saving into a retirement annuity. Do that by considering your country risk overall: are there a lot of things that tie you to South Africa's economy as in that list above, or just a few things?

Don't try to do everything. If you're feeling worried about your country-risk, think through your options and pick just a handful of tangible tasks to prioritise. Your plan doesn't have to be complicated! It could be something as simple as this:

- Go to a forex desk and draw a a small amount of cash as US Dollars to hide safely at home (enough to be helpful in a SHTF situation, not so much that it's a huge problem if it gets stolen).

- Open a Shyft account and convert 10% of your savings into a foreign currency.

- Replace a portion of your monthly retirement savings with an automatic debit order to an EasyEquities tax free savings account, buying a global ETF (you can put in R3000 per person, per month, into a tax free savings account).

If you're feeling befuddled, talk to a good fee-based financial planner for advice.

South Africa has so much going for it, and I still have hope that these difficult times will pass. But it's good to know that there are practical things you can do to sleep better at night, until it does.

You've got this!

xx

S

Member discussion